Is the mortgage industry a good career path? A short guide.

A solid, no bs career guide to career paths. Find job that fits you!

Is the mortgage industry a good career path?

Reviews and data show that the mortgage industry can be a good career path for those who are interested in finance, sales, and customer service. It can offer a stable income, opportunities for advancement, and the ability to help people achieve their dream of homeownership.

Types of jobs in the mortgage industry

The mortgage industry is a vast and complex field that offers a wide range of job opportunities. Some of the most common types of jobs in the mortgage industry include loan officers, underwriters, processors, appraisers, and closers. Loan officers are responsible for helping clients find the right mortgage product and guiding them through the application process. Underwriters review loan applications and determine whether or not to approve them based on the borrower's creditworthiness and financial situation. Processors work with loan officers and underwriters to gather and verify the necessary documentation for loan applications. Appraisers assess the value of properties to ensure that they are worth the amount of the loan. Closers coordinate the final steps of the loan process, including preparing and reviewing closing documents and disbursing funds. Other jobs in the mortgage industry include compliance officers, marketing and sales professionals, and IT specialists.

What do jobs in the US and UK pay in the mortgage industry

According to Glassdoor, the average salary for a mortgage loan officer in the US is around $50,000 to $70,000 per year, while a mortgage underwriter can earn around $60,000 to $80,000 per year. In the UK, the average salary for a mortgage advisor is around £25,000 to £35,000 per year, while a mortgage underwriter can earn around £30,000 to £40,000 per year. However, salaries can vary depending on factors such as experience, location, and company size.

What are the downsides of a career in the mortgage industry

A career in the mortgage industry can be rewarding, but it also has its downsides. One of the biggest challenges is the cyclical nature of the industry. When interest rates are low, the demand for mortgages increases, and there is a lot of business to be had. However, when interest rates rise, the demand for mortgages decreases, and the industry can slow down significantly. This can lead to job insecurity and financial instability for those working in the industry. Another downside is the high level of competition. There are many mortgage companies and brokers vying for business, which can make it difficult to stand out and attract clients. Additionally, the industry is heavily regulated, which can be a burden for those working in it. Compliance with regulations can be time-consuming and costly, and failure to comply can result in fines and legal action. Finally, the mortgage industry can be stressful, with tight deadlines and high-pressure sales environments. This can lead to burnout and a poor work-life balance for those working in the industry.

What are the fastest growing jobs in the mortgage industry

According to the Bureau of Labor Statistics, the fastest-growing jobs in the mortgage industry are loan officers, loan processors, and underwriters. These jobs are expected to grow by 11%, 8%, and 10% respectively from 2019 to 2029.

Your Fit for this job

Discover whether you’re a fit for this and other roles by taking our quick career discovery assessments

Salary data

A major reason why job markets are dysfunctional and inefficient is because of the lack of salary transparency in job postings. Knowing salary expectations on the candidate side and the salaries behind job postings would significantly cut down labor market and recruitment friction. That’s why we set out to gather - both based on user generated data and external data sources - the largest salary dataset on remote and hybrid jobs.

Check out our remote job board

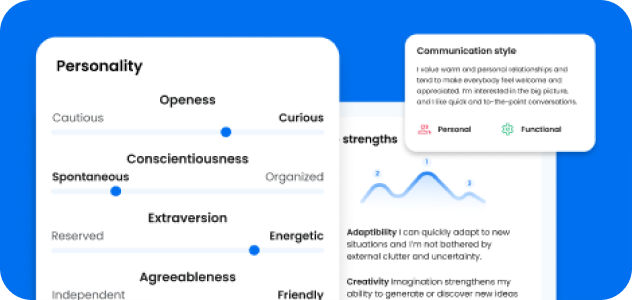

Free Personality tests

All of the following assessment tools explore an individual's personality thoroughly, although the Big5 is the gold standard among personality assessments. And what’s key is that are all available for free here: