Is specialty insurers a good career path? A short guide.

A solid, no bs career guide to career paths. Find job that fits you!

Is Specialty Insurers a Good Career Path?

Specialty insurers are companies that provide insurance coverage for unique or specialized risks that are not typically covered by standard insurance policies. These risks can range from cyber liability to aviation insurance. If you are interested in a career in the insurance industry, specialty insurers can be a great career path to consider.

Types of Jobs in Specialty Insurers

Specialty insurers offer a wide range of job opportunities, including underwriters, claims adjusters, risk managers, and actuaries. Underwriters are responsible for evaluating risks and determining the terms and conditions of insurance policies. Claims adjusters investigate and settle insurance claims. Risk managers identify and assess potential risks and develop strategies to mitigate them. Actuaries use statistical analysis to assess risk and determine insurance premiums.

How Best to Start a Career in Specialty Insurers?

To start a career in specialty insurers, you will need a degree in a relevant field such as business, finance, or mathematics. Many employers also require professional certifications such as the Chartered Property Casualty Underwriter (CPCU) designation. Internships and entry-level positions can also provide valuable experience and help you get your foot in the door.

What Do Jobs in the US and UK Pay in Specialty Insurers?

Salaries in specialty insurers vary depending on the job and location. According to Glassdoor, the average salary for an underwriter in the US is $72,000 per year, while the average salary for a claims adjuster is $54,000 per year. In the UK, the average salary for an underwriter is £35,000 per year, while the average salary for a claims adjuster is £25,000 per year.

What Are the Downsides of a Career in Specialty Insurers?

Like any career, there are downsides to working in specialty insurers. One of the biggest challenges is the constantly changing nature of the industry. As new risks emerge, insurers must adapt and develop new products and services to meet the needs of their clients. This can be stressful and require a lot of hard work and dedication. Additionally, the industry can be highly competitive, and there is often pressure to meet sales targets and revenue goals.

What Are the Fastest Growing Jobs in Specialty Insurers?

According to the Bureau of Labor Statistics, the fastest-growing jobs in the insurance industry include actuaries, claims adjusters, and underwriters. These jobs are expected to grow by 18%, 4%, and 3%, respectively, between 2019 and 2029. As the insurance industry continues to evolve and new risks emerge, these jobs will become increasingly important in helping insurers manage risk and protect their clients.

Your Fit for this job

Discover whether you’re a fit for this and other roles by taking our quick career discovery assessments

Salary data

A major reason why job markets are dysfunctional and inefficient is because of the lack of salary transparency in job postings. Knowing salary expectations on the candidate side and the salaries behind job postings would significantly cut down labor market and recruitment friction. That’s why we set out to gather - both based on user generated data and external data sources - the largest salary dataset on remote and hybrid jobs.

Check out our remote job board

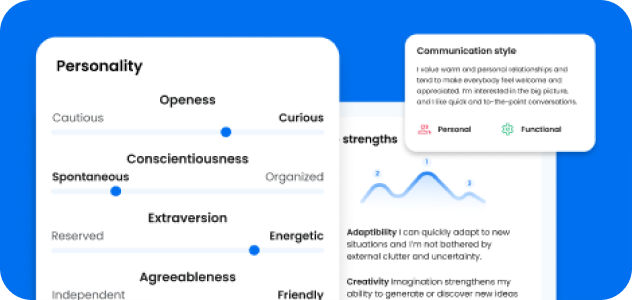

Free Personality tests

All of the following assessment tools explore an individual's personality thoroughly, although the Big5 is the gold standard among personality assessments. And what’s key is that are all available for free here: