Is real estate investment trusts a good career path? A short guide.

A solid, no bs career guide to career paths. Find job that fits you!

Is Real Estate Investment Trusts a Good Career Path?

Real estate investment trusts (REITs) are companies that own and operate income-generating real estate properties. They are a popular investment option for those looking to diversify their portfolio and earn passive income. But is a career in REITs a good option? Let's explore.

Types of Jobs in Real Estate Investment Trusts

REITs offer a wide range of job opportunities, from property management to finance and accounting. Some of the most common jobs in REITs include property managers, asset managers, financial analysts, and accountants. Other roles include leasing agents, marketing specialists, and construction managers. With such a diverse range of jobs available, there is something for everyone in REITs.

How Best to Start a Career in Real Estate Investment Trusts?

Starting a career in REITs requires a combination of education and experience. A degree in finance, real estate, or business is a good starting point. Many REITs also offer internships and entry-level positions that can help you gain valuable experience and build your network. Networking is key in the real estate industry, so attending industry events and joining professional organizations can also be beneficial.

What Do Jobs in the US and UK Pay in Real Estate Investment Trusts?

Salaries in REITs vary depending on the job and location. In the US, property managers can earn an average of $60,000 per year, while financial analysts can earn upwards of $80,000 per year. In the UK, property managers can earn an average of £30,000 per year, while financial analysts can earn upwards of £50,000 per year. It's important to note that salaries can vary greatly depending on the size and type of REIT.

What Are the Downsides of a Career in Real Estate Investment Trusts?

Like any career, there are downsides to working in REITs. One of the biggest challenges is the cyclical nature of the real estate market. When the market is down, REITs may struggle to generate income and may have to cut jobs or reduce salaries. Additionally, working in REITs can be demanding, with long hours and high-pressure situations. It's important to weigh the pros and cons before pursuing a career in REITs.

What Are the Fastest Growing Jobs in Real Estate Investment Trusts?

As the real estate market continues to grow, so do the job opportunities in REITs. Some of the fastest-growing jobs in REITs include data analysts, sustainability specialists, and technology experts. With the rise of smart buildings and the increasing importance of sustainability, these roles are becoming more and more important in the industry. Additionally, as REITs continue to expand globally, there is a growing need for professionals with international experience and language skills.

Your Fit for this job

Discover whether you’re a fit for this and other roles by taking our quick career discovery assessments

Salary data

A major reason why job markets are dysfunctional and inefficient is because of the lack of salary transparency in job postings. Knowing salary expectations on the candidate side and the salaries behind job postings would significantly cut down labor market and recruitment friction. That’s why we set out to gather - both based on user generated data and external data sources - the largest salary dataset on remote and hybrid jobs.

Check out our remote job board

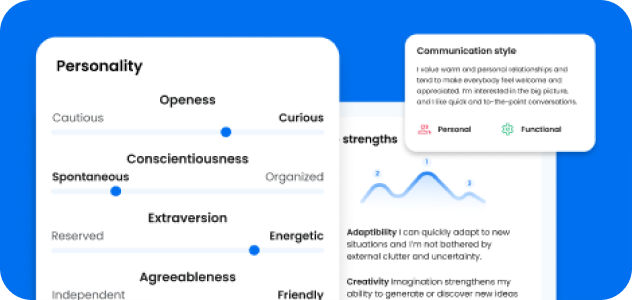

Free Personality tests

All of the following assessment tools explore an individual's personality thoroughly, although the Big5 is the gold standard among personality assessments. And what’s key is that are all available for free here: