Is private equity a good career path? A short guide.

A solid, no bs career guide to career paths. Find job that fits you!

Is Private Equity a Good Career Path? A Short Guide

Private equity is a type of investment that involves buying and selling companies. It is a highly competitive industry that requires a lot of hard work and dedication. However, it can also be a very rewarding career path for those who are willing to put in the effort. In this blog post, we will explore the different types of jobs in private equity, how to start a career in this field, the salaries in the US and UK, the downsides of a career in private equity, and the fastest-growing jobs in this industry.

Types of Jobs in Private Equity

There are several types of jobs in private equity, including analysts, associates, vice presidents, and partners. Analysts are responsible for conducting research and analysis on potential investments. Associates work closely with analysts and are responsible for managing the due diligence process. Vice presidents are responsible for managing the deal process and working with the portfolio companies. Partners are responsible for managing the overall strategy of the firm and making investment decisions.

How Best to Start a Career in Private Equity?

Starting a career in private equity can be challenging, but there are several ways to get started. One way is to get an MBA from a top business school. Another way is to work in investment banking or consulting and then transition to private equity. Networking is also essential in this industry, so attending industry events and building relationships with people in the field can be helpful.

What Do Jobs in the US and UK Pay in Private Equity?

Salaries in private equity can vary depending on the level of experience and the location. In the US, analysts can expect to earn between $80,000 and $150,000 per year, while associates can earn between $150,000 and $300,000 per year. Vice presidents can earn between $300,000 and $500,000 per year, and partners can earn over $1 million per year. In the UK, salaries are generally lower, with analysts earning between £50,000 and £80,000 per year, associates earning between £80,000 and £150,000 per year, and vice presidents earning between £150,000 and £250,000 per year.

What Are the Downsides of a Career in Private Equity?

While private equity can be a rewarding career path, there are also some downsides to consider. The hours can be long and unpredictable, and the work can be very demanding. The industry is also highly competitive, and there is a lot of pressure to perform. Additionally, the work can be very transactional, and there may not be as much opportunity for creativity or innovation as in other industries.

What Are the Fastest Growing Jobs in Private Equity?

The fastest-growing jobs in private equity are in areas such as technology, healthcare, and renewable energy. These industries are experiencing rapid growth, and private equity firms are investing heavily in them. There is also a growing demand for professionals with expertise in ESG (environmental, social, and governance) investing, as more investors are looking for socially responsible investment opportunities.

Your Fit for this job

Discover whether you’re a fit for this and other roles by taking our quick career discovery assessments

Salary data

A major reason why job markets are dysfunctional and inefficient is because of the lack of salary transparency in job postings. Knowing salary expectations on the candidate side and the salaries behind job postings would significantly cut down labor market and recruitment friction. That’s why we set out to gather - both based on user generated data and external data sources - the largest salary dataset on remote and hybrid jobs.

Check out our remote job board

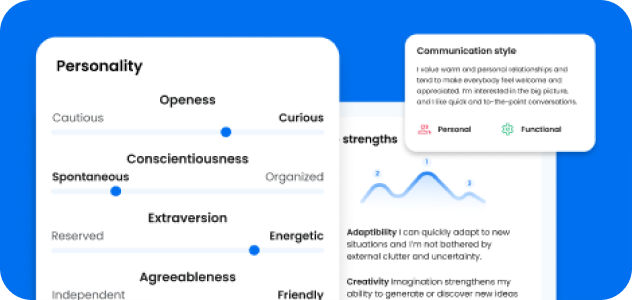

Free Personality tests

All of the following assessment tools explore an individual's personality thoroughly, although the Big5 is the gold standard among personality assessments. And what’s key is that are all available for free here: