Is major banks a good career path? A short guide.

A solid, no bs career guide to career paths. Find job that fits you!

Is Major Banks a Good Career Path? A Short Guide

If you're considering a career in the banking industry, you may be wondering if major banks are a good career path. The answer is yes, but it depends on your interests, skills, and career goals. In this short guide, we'll explore the types of jobs available in major banks, how to start a career in banking, the pay scale in the US and UK, the downsides of a career in banking, and the fastest-growing jobs in the industry.

Types of Jobs in Major Banks

Major banks offer a wide range of job opportunities, from entry-level positions to executive roles. Some of the most common jobs in banking include tellers, customer service representatives, loan officers, financial analysts, investment bankers, and wealth managers. Each of these roles requires different skills and qualifications, so it's important to research the job requirements before applying.

How Best to Start a Career in Major Banks?

Starting a career in banking requires a combination of education, experience, and networking. Most entry-level positions in banking require a bachelor's degree in finance, accounting, or a related field. However, some banks offer training programs for recent graduates or individuals with no prior banking experience. Networking is also important in the banking industry, as many jobs are filled through referrals or recommendations.

What Do Jobs in the US and UK Pay in Major Banks?

The pay scale for jobs in major banks varies depending on the position, location, and experience level. In the US, the average salary for a teller is $30,000 per year, while a financial analyst can earn upwards of $80,000 per year. In the UK, the average salary for a customer service representative is £18,000 per year, while an investment banker can earn over £100,000 per year. It's important to note that salaries can vary widely depending on the bank and the specific job.

What Are the Downsides of a Career in Major Banks?

While a career in banking can be rewarding, there are some downsides to consider. One of the biggest challenges is the long hours and high-pressure environment, especially for those in investment banking or other high-level positions. Additionally, the banking industry is highly regulated, which can lead to a lot of paperwork and bureaucracy. Finally, the industry is subject to economic cycles, which can lead to job instability during downturns.

What Are the Fastest Growing Jobs in Major Banks?

The banking industry is constantly evolving, and there are several fast-growing jobs to consider. One of the most in-demand roles is cybersecurity, as banks are increasingly vulnerable to cyber attacks. Other growing areas include data analytics, compliance, and digital banking. These roles require specialized skills and training, but they offer excellent career growth opportunities.

Your Fit for this job

Discover whether you’re a fit for this and other roles by taking our quick career discovery assessments

Salary data

A major reason why job markets are dysfunctional and inefficient is because of the lack of salary transparency in job postings. Knowing salary expectations on the candidate side and the salaries behind job postings would significantly cut down labor market and recruitment friction. That’s why we set out to gather - both based on user generated data and external data sources - the largest salary dataset on remote and hybrid jobs.

Check out our remote job board

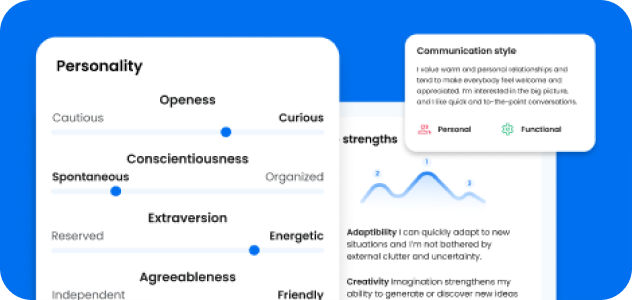

Free Personality tests

All of the following assessment tools explore an individual's personality thoroughly, although the Big5 is the gold standard among personality assessments. And what’s key is that are all available for free here: