Is life insurance a good career path? A short guide.

A solid, no bs career guide to career paths. Find job that fits you!

Is Life Insurance a Good Career Path?

If you're looking for a career that offers stability, growth, and the opportunity to help people, then life insurance might be the perfect fit for you. The life insurance industry is a multi-billion dollar industry that is always in demand, making it a great career path for those who are looking for job security.

Types of Jobs in Life Insurance

There are a variety of jobs available in the life insurance industry, ranging from sales and marketing to underwriting and claims. Sales agents are responsible for selling life insurance policies to clients, while underwriters assess the risk of insuring a particular individual. Claims adjusters, on the other hand, are responsible for investigating and settling claims.

How Best to Start a Career in Life Insurance?

To start a career in life insurance, you'll need to obtain the necessary licenses and certifications. Most states require that you pass a licensing exam before you can sell insurance, and some employers may require additional certifications. You can also gain experience by working as an intern or apprentice with an established insurance company.

What Do Jobs in the US and UK Pay in Life Insurance?

The pay for jobs in the life insurance industry varies depending on the position and location. In the US, the average salary for a life insurance agent is around $50,000 per year, while underwriters and claims adjusters can earn upwards of $70,000 per year. In the UK, the average salary for a life insurance agent is around £25,000 per year, while underwriters and claims adjusters can earn upwards of £40,000 per year.

What Are the Downsides of a Career in Life Insurance?

Like any career, there are downsides to working in the life insurance industry. One of the biggest challenges is the high-pressure sales environment, which can be stressful for some people. Additionally, the industry is highly regulated, which can make it difficult to navigate for those who are new to the field.

What Are the Fastest Growing Jobs in Life Insurance?

The fastest growing jobs in the life insurance industry are those that are focused on technology and innovation. As the industry becomes more digital, there is a growing need for professionals who can develop and implement new technologies. Some of the fastest growing jobs in the industry include data analysts, software developers, and digital marketing specialists.

Your Fit for this job

Discover whether you’re a fit for this and other roles by taking our quick career discovery assessments

Salary data

A major reason why job markets are dysfunctional and inefficient is because of the lack of salary transparency in job postings. Knowing salary expectations on the candidate side and the salaries behind job postings would significantly cut down labor market and recruitment friction. That’s why we set out to gather - both based on user generated data and external data sources - the largest salary dataset on remote and hybrid jobs.

Check out our remote job board

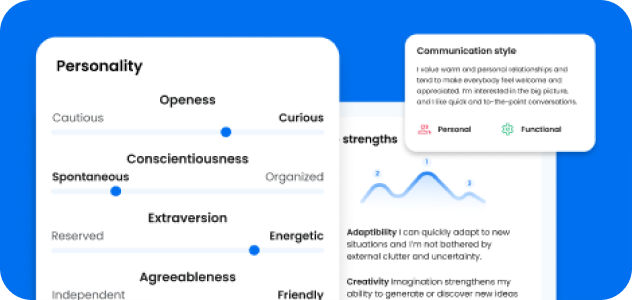

Free Personality tests

All of the following assessment tools explore an individual's personality thoroughly, although the Big5 is the gold standard among personality assessments. And what’s key is that are all available for free here: