Is insurance a good career path? A short guide.

A solid, no bs career guide to career paths. Find job that fits you!

Is insurance a good career path?

Reviews and data show that insurance can be a good career path for those who are interested in risk management, finance, and customer service. The insurance industry offers a wide range of job opportunities, including underwriting, claims adjusting, sales, marketing, and actuarial science. Insurance professionals can also specialize in different areas such as property and casualty, life and health, or reinsurance. The industry is stable and growing, and there is a high demand for skilled professionals. Additionally, insurance companies often offer competitive salaries, benefits, and opportunities for career advancement.

Types of jobs in insurance

There are a variety of jobs available in the insurance industry, ranging from entry-level positions to executive roles. Some of the most common types of jobs in insurance include sales agents, underwriters, claims adjusters, actuaries, and risk managers.

Sales agents are responsible for selling insurance policies to individuals and businesses. They may work for an insurance company or as an independent agent. Underwriters evaluate insurance applications and determine whether to approve or deny coverage based on risk factors. Claims adjusters investigate and settle insurance claims, working with policyholders and other parties involved in the claim.

Actuaries use statistical analysis to assess risk and determine insurance premiums. They may work for insurance companies, consulting firms, or government agencies. Risk managers identify and assess potential risks to a company and develop strategies to mitigate those risks.

Other jobs in insurance include customer service representatives, marketing and advertising professionals, and IT specialists who develop and maintain insurance software systems. Many insurance companies also employ lawyers, accountants, and other professionals to provide legal and financial advice.

Overall, the insurance industry offers a wide range of career opportunities for individuals with diverse skills and interests. Whether you are interested in sales, analysis, or management, there is likely a job in insurance that will suit your career goals.

What do jobs in the US and UK pay in insurance

According to Glassdoor, the average salary for an insurance agent in the US is $40,000 per year, while the average salary for an insurance underwriter is $70,000 per year. In the UK, the average salary for an insurance broker is £25,000-£30,000 per year, while the average salary for an insurance underwriter is £30,000-£40,000 per year. These figures may vary depending on the company, location, and level of experience.

What are the downsides of a career in insurance

A career in insurance can be a lucrative and rewarding one, but it also has its downsides. One of the biggest downsides is the high level of competition in the industry. With so many insurance companies and agents vying for business, it can be difficult to stand out and build a successful career. Additionally, the job can be stressful, as agents are often responsible for meeting sales quotas and dealing with difficult clients. The industry is also heavily regulated, which can make it challenging to navigate and keep up with changes in laws and regulations. Finally, insurance can be a complex and technical field, requiring a significant amount of training and education to fully understand the products and services being offered.

What are the fastest growing jobs in insurance

According to the Bureau of Labor Statistics, the fastest-growing jobs in the insurance industry include:

1. Insurance sales agents

2. Claims adjusters, examiners, and investigators

3. Insurance underwriters

4. Actuaries

5. Insurance appraisers, auto damage

6. Insurance customer service representatives

7. Insurance brokers and agents

8. Insurance claims and policy processing clerks

9. Insurance risk management specialists

10. Insurance marketing and advertising managers.

Your Fit for this job

Discover whether you’re a fit for this and other roles by taking our quick career discovery assessments

Salary data

A major reason why job markets are dysfunctional and inefficient is because of the lack of salary transparency in job postings. Knowing salary expectations on the candidate side and the salaries behind job postings would significantly cut down labor market and recruitment friction. That’s why we set out to gather - both based on user generated data and external data sources - the largest salary dataset on remote and hybrid jobs.

Check out our remote job board

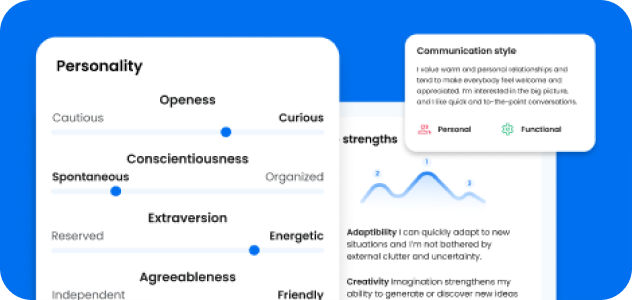

Free Personality tests

All of the following assessment tools explore an individual's personality thoroughly, although the Big5 is the gold standard among personality assessments. And what’s key is that are all available for free here: