Is commercial banking a good career path? A short guide.

A solid, no bs career guide to career paths. Find job that fits you!

Is Commercial Banking a Good Career Path?

Commercial banking is a great career path for those who are interested in finance and enjoy working with people. It is a dynamic industry that offers a wide range of opportunities for growth and development. Commercial banking is a good career path for those who are looking for a challenging and rewarding career.

Types of Jobs in Commercial Banking

There are many different types of jobs in commercial banking. Some of the most common jobs include commercial banker, credit analyst, loan officer, and branch manager. Commercial bankers work with businesses to help them manage their finances and achieve their financial goals. Credit analysts evaluate the creditworthiness of potential borrowers. Loan officers work with customers to help them obtain loans. Branch managers oversee the operations of a bank branch.

How Best to Start a Career in Commercial Banking?

The best way to start a career in commercial banking is to obtain a degree in finance, accounting, or business. Many banks offer internships and entry-level positions for recent graduates. It is also important to develop strong communication and analytical skills. Networking is also important in the banking industry, so it is a good idea to attend industry events and join professional organizations.

What Do Jobs in the US and UK Pay in Commercial Banking?

The salaries for jobs in commercial banking vary depending on the position and location. In the US, the average salary for a commercial banker is around $80,000 per year. Credit analysts and loan officers earn around $60,000 per year. Branch managers earn around $70,000 per year. In the UK, the average salary for a commercial banker is around £50,000 per year. Credit analysts and loan officers earn around £35,000 per year. Branch managers earn around £45,000 per year.

What Are the Downsides of a Career in Commercial Banking?

One of the downsides of a career in commercial banking is the long hours. Many bankers work more than 40 hours per week and may be required to work weekends and holidays. The job can also be stressful, as bankers are responsible for managing large amounts of money and making important financial decisions. Additionally, the industry is highly regulated, which can make it difficult to innovate and adapt to changing market conditions.

What Are the Fastest Growing Jobs in Commercial Banking?

The fastest growing jobs in commercial banking include data analysts, compliance officers, and cybersecurity specialists. Data analysts are responsible for analyzing large amounts of data to identify trends and make informed business decisions. Compliance officers ensure that banks are following all relevant laws and regulations. Cybersecurity specialists are responsible for protecting banks from cyber threats and ensuring that customer data is secure. These jobs are in high demand as banks continue to invest in technology and cybersecurity.

Your Fit for this job

Discover whether you’re a fit for this and other roles by taking our quick career discovery assessments

Salary data

A major reason why job markets are dysfunctional and inefficient is because of the lack of salary transparency in job postings. Knowing salary expectations on the candidate side and the salaries behind job postings would significantly cut down labor market and recruitment friction. That’s why we set out to gather - both based on user generated data and external data sources - the largest salary dataset on remote and hybrid jobs.

Check out our remote job board

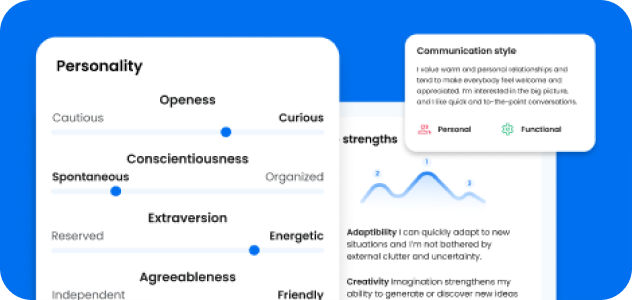

Free Personality tests

All of the following assessment tools explore an individual's personality thoroughly, although the Big5 is the gold standard among personality assessments. And what’s key is that are all available for free here: