Is banks a good career path? A short guide.

A solid, no bs career guide to career paths. Find job that fits you!

Is banks a good career path?

Reviews and data show that banking can be a good career path for those who are interested in finance, economics, and business. It offers a wide range of job opportunities, including customer service, financial analysis, investment banking, and risk management. Banks also provide competitive salaries, benefits, and opportunities for career advancement.

Types of jobs in banks

Banks offer a wide range of job opportunities for individuals with different skill sets and educational backgrounds. Some of the most common types of jobs in banks include customer service representatives, tellers, loan officers, financial analysts, investment bankers, and branch managers. Customer service representatives are responsible for answering customer inquiries, resolving complaints, and providing information about bank products and services. Teller positions involve handling cash transactions, processing deposits and withdrawals, and providing basic financial advice to customers. Loan officers evaluate loan applications, determine creditworthiness, and make lending decisions. Financial analysts analyze financial data and provide recommendations to clients on investment opportunities. Investment bankers work with corporate clients to raise capital through the issuance of stocks and bonds. Finally, branch managers oversee the day-to-day operations of a bank branch, including managing staff, ensuring compliance with regulations, and meeting sales targets. Overall, banks offer a diverse range of job opportunities for individuals interested in finance and banking.

What do jobs in the US and UK pay in banks

According to Glassdoor, the average salary for a banker in the US is $85,000 per year, while in the UK, it is £50,000 per year. However, salaries can vary depending on the specific job title, location, and experience level.

What are the downsides of a career in banks

A career in banks can be a lucrative and rewarding one, but it also comes with its downsides. One of the biggest downsides is the long working hours. Banks are known for their demanding work schedules, and employees are often required to work long hours, including weekends and holidays. This can lead to burnout and a poor work-life balance. Another downside is the high-pressure environment. Banks are highly competitive, and employees are expected to meet strict targets and deadlines. This can lead to stress and anxiety, which can have a negative impact on mental health. Additionally, the banking industry is highly regulated, and employees are required to comply with a range of rules and regulations. This can be challenging and time-consuming, and mistakes can result in serious consequences. Finally, the banking industry is subject to economic cycles, and downturns can lead to job losses and uncertainty.

What are the fastest growing jobs in banks

According to the Bureau of Labor Statistics, some of the fastest growing jobs in the banking industry include financial analysts, loan officers, and personal financial advisors. These jobs are expected to grow at a rate of 5-7% over the next decade. Additionally, there is a growing demand for cybersecurity professionals in the banking industry due to the increasing threat of cyber attacks.

Your Fit for this job

Discover whether you’re a fit for this and other roles by taking our quick career discovery assessments

Salary data

A major reason why job markets are dysfunctional and inefficient is because of the lack of salary transparency in job postings. Knowing salary expectations on the candidate side and the salaries behind job postings would significantly cut down labor market and recruitment friction. That’s why we set out to gather - both based on user generated data and external data sources - the largest salary dataset on remote and hybrid jobs.

Check out our remote job board

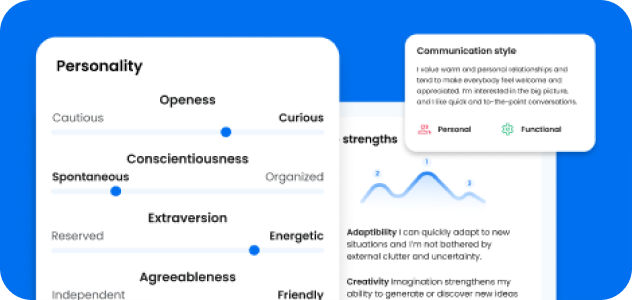

Free Personality tests

All of the following assessment tools explore an individual's personality thoroughly, although the Big5 is the gold standard among personality assessments. And what’s key is that are all available for free here: